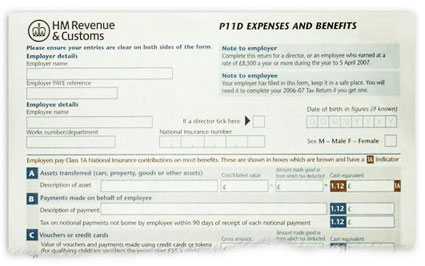

Company cars are considered a Benefit In Kind (BIK) and, therefore, they are subject to tax from HM Revenue & Customs (HMRC). A car is not deemed a necessity so it’s viewed as an additional perk that you get on top of your annual salary.

Company car tax can be a bit perplexing to those who are new to the system. Normal VED car tax is calculated by merely taking into account CO2 em…

Continue Reading