Budget Report 2020: Duties

Alcohol and tobacco duties

The duty rates remain frozen for beer, spirits, wine and made-wine, still and sparkling cider and perry.

The duty rate on all tobacco products will continue to increase by 2% above RPI inflation. The duty rate on hand-rolling tobacco will increase by a further 4%. These rates will have effect from 11 March 2020.

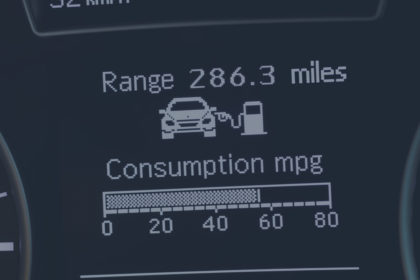

Fuel duty

Fuel duty will be frozen for the 2020/21 tax year.

Please see the pages below for more information

Income Tax and Personal Savings

Tags.budget, budget 2020